Our mission is to digitize all aspects of the mortgage industry, striving to automate lending processes for enhanced speed, security, and efficiency. By embracing our solutions, businesses can expect increased return on investment, streamlined workflows, and expanded customer reach.

to make mortgage operations

Easy, Safe and Secure

Awesome Technologies Inc. creates custom software and services to improve the lending process, streamline operations, lower origination cost, enhance borrower

retention and hence for retention, while helping you create customers for life.

Mortgage companies that witnessed our AWESOME services!

OUR SERVICES

We uphold the latest stack of tools & technology to deliver you up-to-date solutions with consistency.

Encompass® Services

BytePro Services

MeridianLink Services

Sharepoint Services

Mortgage Custom Development

Maximize the Potential of Your LOS (Loan Origination System) Instance

Imagine a world where commission management is a breeze: no more manual calculations or outdated spreadsheets. While our solution automates the process, you can focus on closing deals and celebrating your sales team’s accomplishments. A farewell to commission headaches.

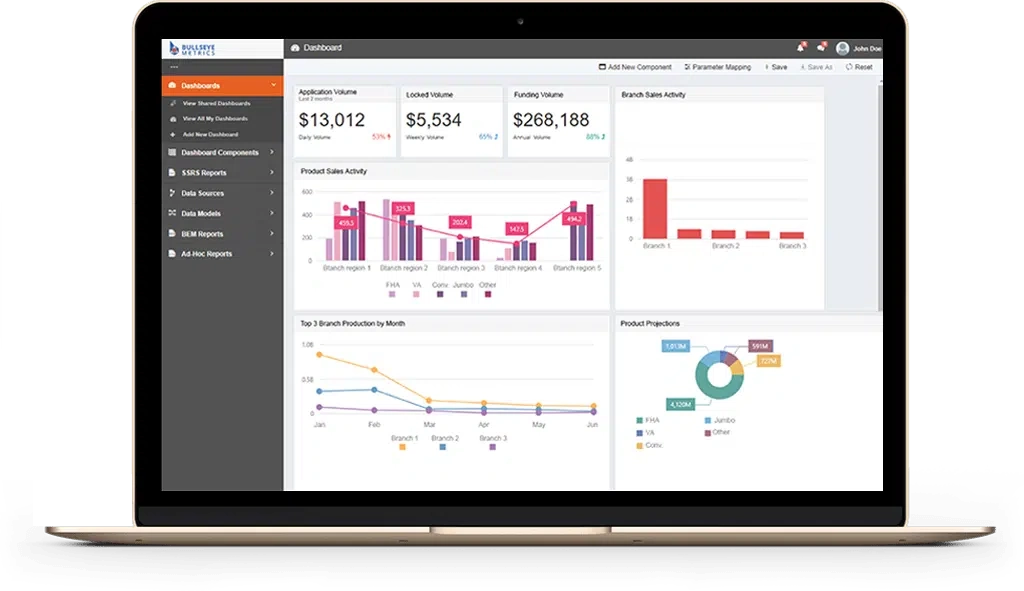

Unleash the power of data visualization by converting intricate data into meaningful visual representations. Empower your entire team to make data-driven decisions and propel your business toward success, one visualization at a time. Take control of your data analysis journey.

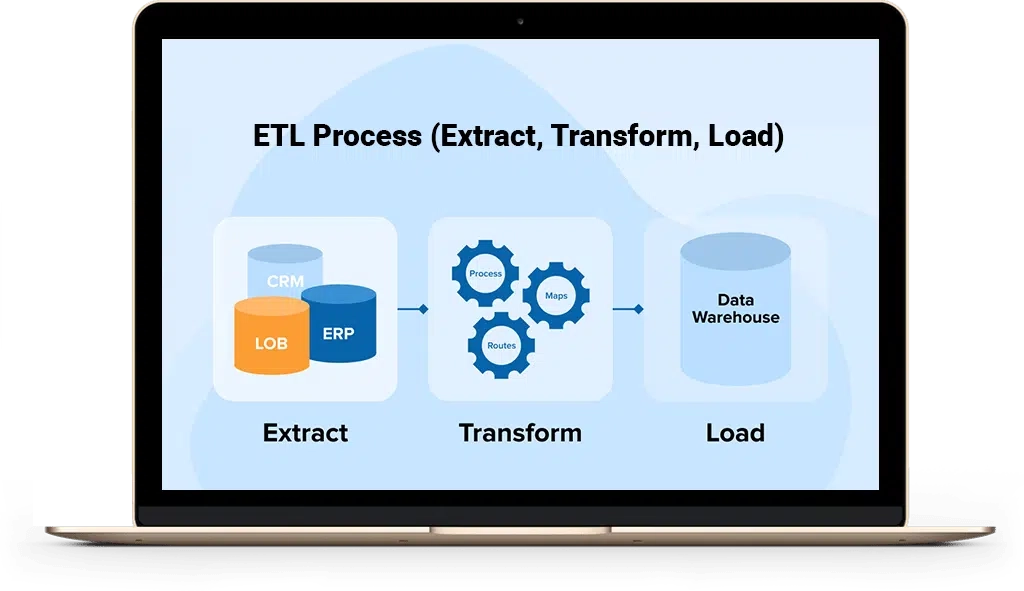

Say goodbye to the hassle of managing multiple data tools. No more data chaos as you effortlessly extract, transform, and load your data, ensuring that your tables remain in pristine condition for even the most data-hungry users.

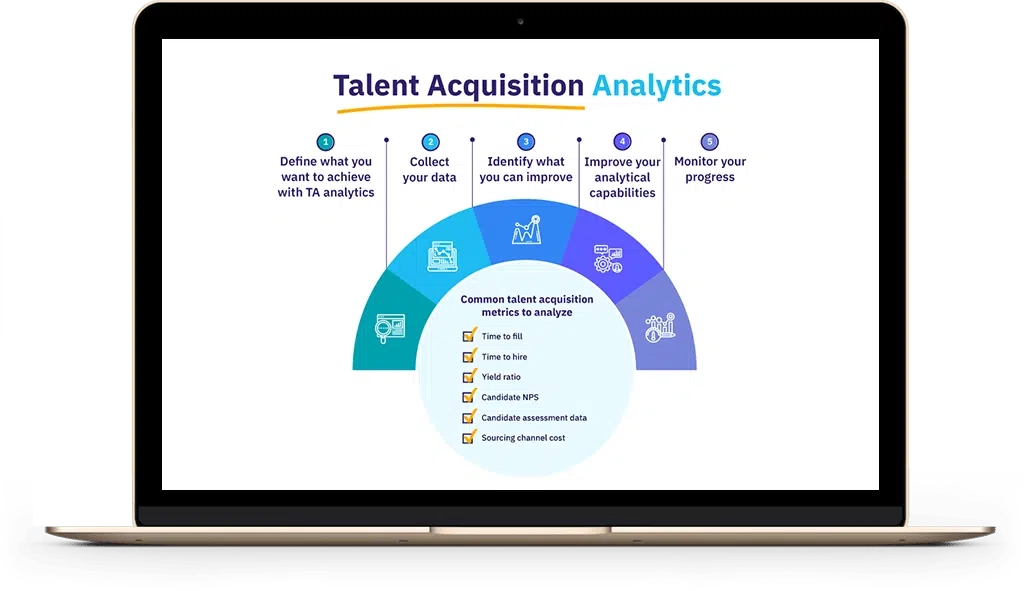

Elevate your hiring process with our recruitment software. Bid farewell to manual sorting and screening. Embrace automated workflows that free you to focus on connecting with the best candidates and celebrating your recruitment victories. Say good-bye to hiring hassles.

Leave behind disjointed interactions and scattered information. Seamlessly organize customer data into meaningful narratives that guide your team towards informed decisions, one connection at a time. Embrace the reins of customer relation management solutions.

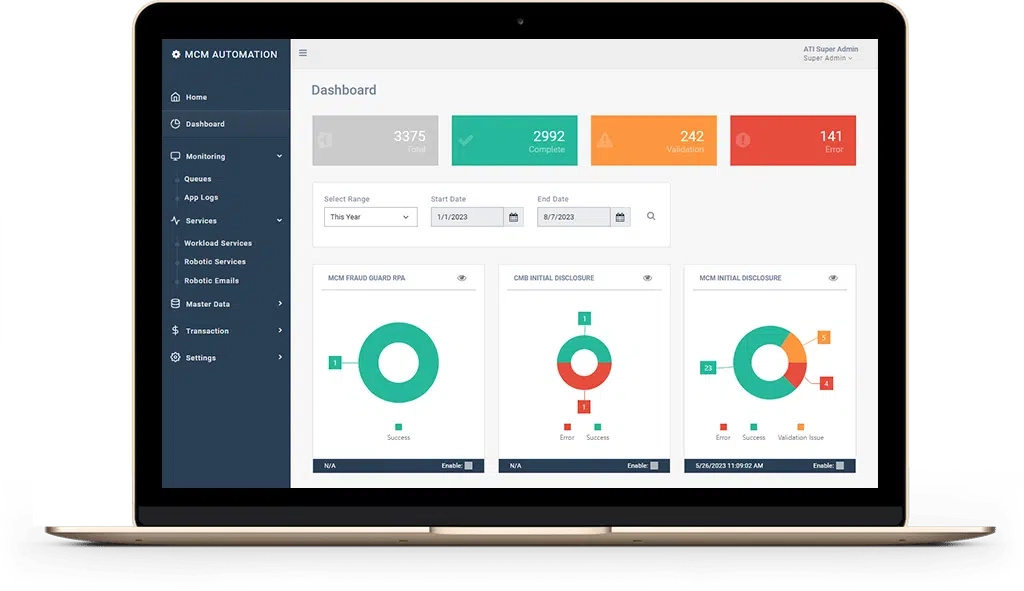

No more manual application processing or tedious verification. Harness automation to streamline your lending workflows, enabling you to concentrate on forging customer relationships and rejoicing in lending accomplishments.

OUR COLLECTION OF INNOVATIVE TOOLS

Our Hand-Crafted Tools, Plugins & Solutions Make Your Encompass® Instance Better

AN ABUNDANCE OF TECHNOLOGICAL DELIGHTS

Discover the transformative power of these incredible tools that fit into your loan-originating system. Built with security and compliance in mind, our Encompass® tools and plugins adhere to industry standards to safeguard sensitive loan data.

Byte Software, LLC